Marketing attribution 360

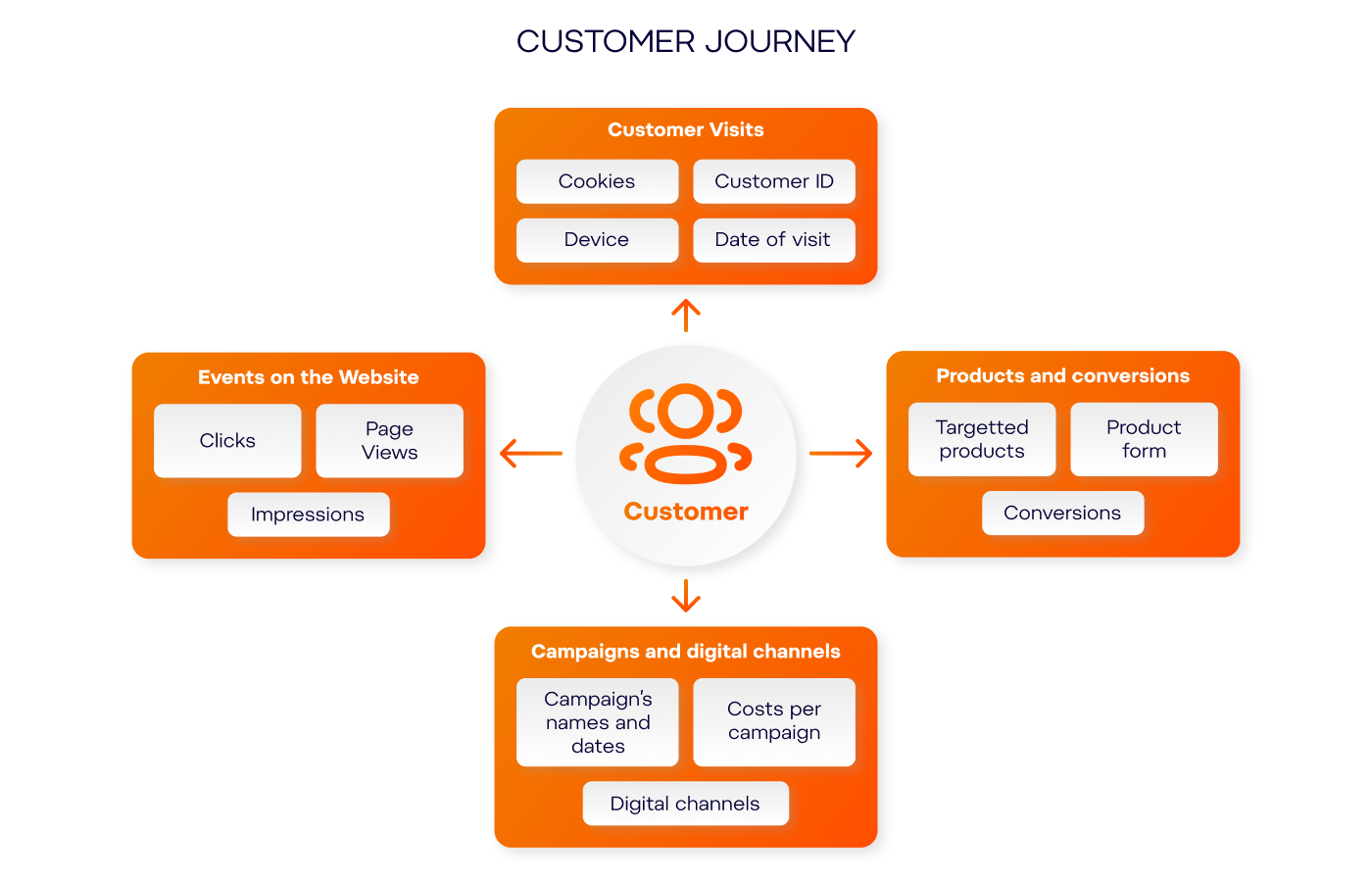

Marketing teams use multiple channels to drive website traffic. Visitors often return to the website numerous times and from different channels before they finally make a conversion. The question is – which channel should be attributed the conversion to optimise ad spend. The answer could be generated with the help of data-driven marketing attribution implemented by DataSentics FinTech.

Business case

Business rules or heuristic models are still the most common way to solve the attribution problem. However, whereas heuristic models are crude, straightforward, and might work reasonably well if there are just a few channels and short customer journeys, they do not provide actionable results to optimise your marketing spend.

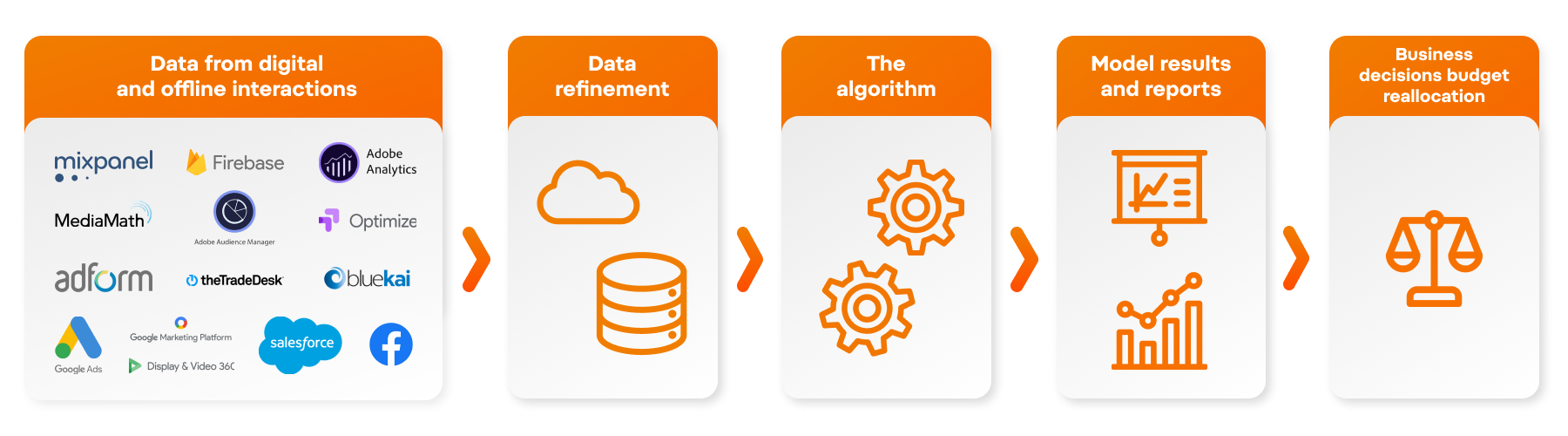

Data-driven algorithms can significantly improve the attribution accuracy – they are invariant to the length of the customer journey and reveal which marketing channels have a tangible impact on conversions. Furthermore, data-driven models can protect the overspending of insufficient approaches and optimally redistribute the budget to the proper channels at the right time.

Solution

Combining cloud computing services and modern data-driven models can allow digital attribution to fully understand the customer experience and the key marketing channels to realise which marketing channels empower digital business.

Implementing the attribution data-driven model allows us to obtain marketing insights, making the process more efficient. Additionally, there is a wide variety of options in the attribution model, ranging from Markov Chain models and supervised models, to models based on Shapley values or artificial recurrent neural network (RNN).

Benefits

- Understanding the online/offline behaviour of customers and their reaction to the marketing decisions helps optimise the ad spend.

- Identifying the problems in the budget allocation and hidden potential for growth allows for predicting and simulating the outcomes of business decisions.

- The attribution model is scalable for more channels and products, as well as automated, reliable, and reproducible

Enter your E-mail address and name to watch

Need to know More?

Ask us anything

Key contacts

David Vopelka

FinTech lead | AI & personalisation expert

Search

Search