The Opportunity We Help You Harness

The breakthrough of AI brings massive opportunities for FSI companies: boosting upsell, cross-sell, and retention strategies with personalization deploying dynamic pricing; improving risk models, and more. The challenge lies in integrating AI into existing systems and environment, meeting regulatory requirements, and developing use cases quickly, without reinventing the wheel.

Pre-Built Solutions to Accelerate Your AI Ambitions

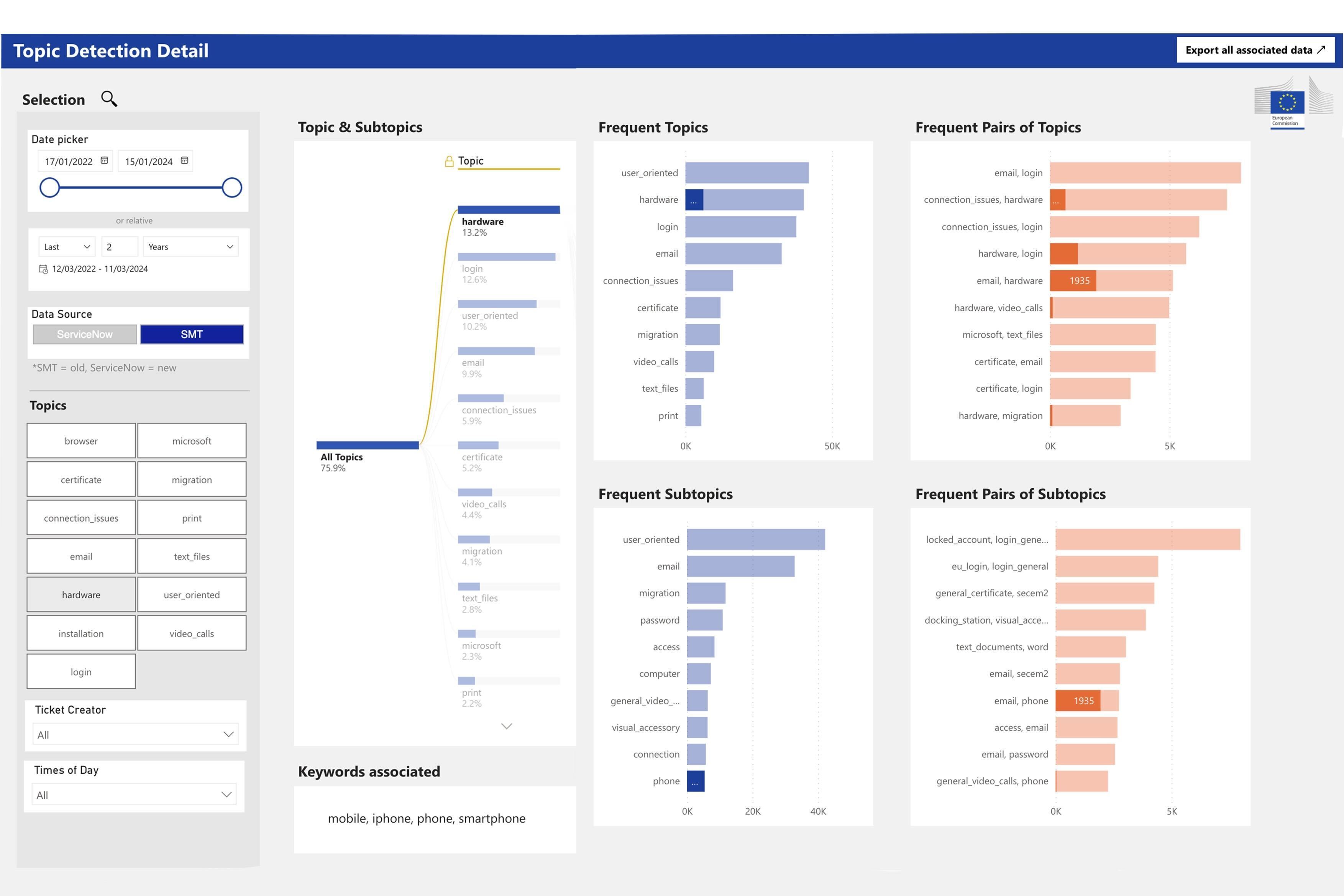

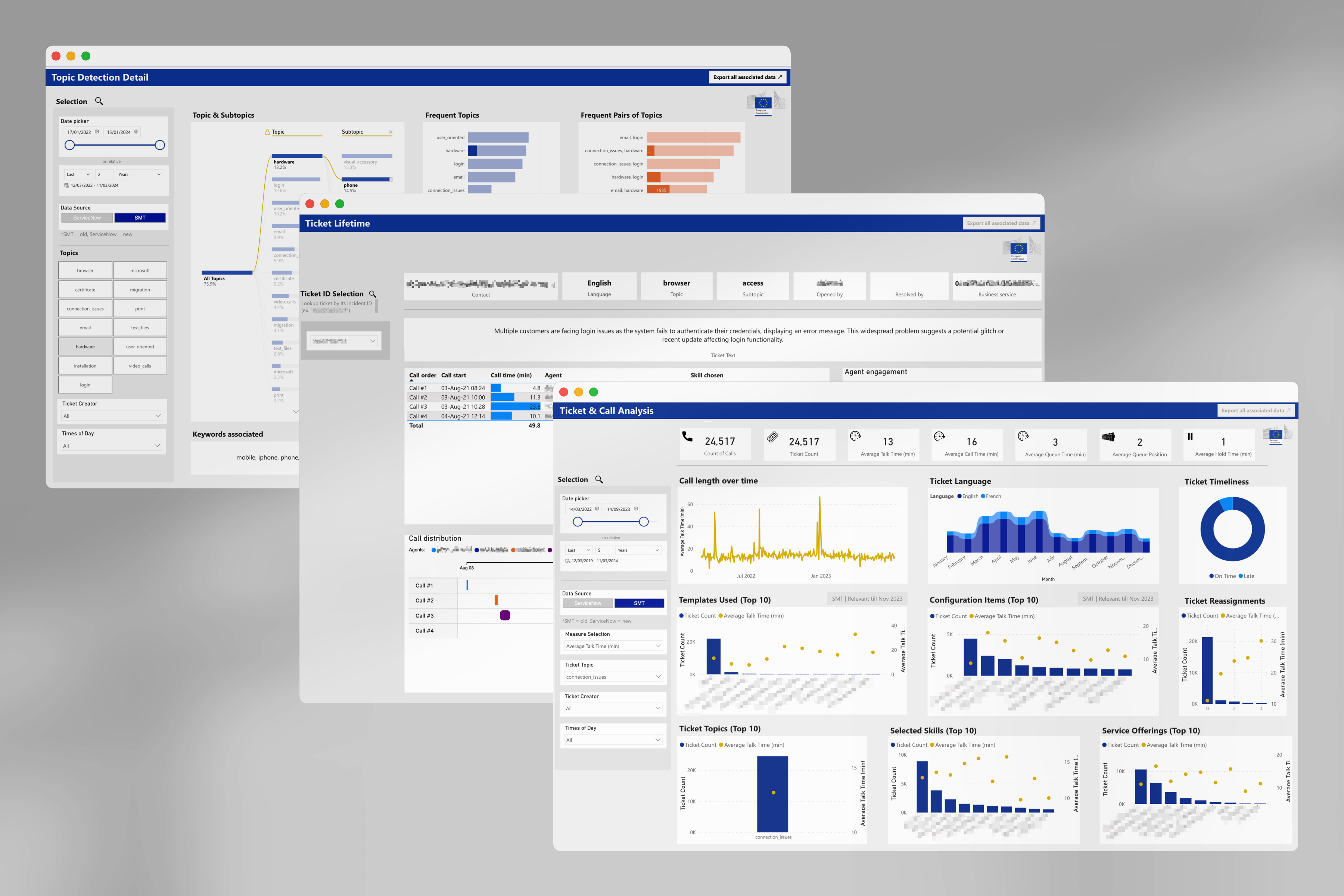

AI-Driven Call Center

Key Solutions:

- Monitoring calls and identifying agent performance issues.

- Augmenting agents by providing process guidelines accessible via a GPT chat (acting as a "Virtual MS Team" colleague).

- Automating calls with an AI agent.

- Automatically categorizing and routing inbound communication.

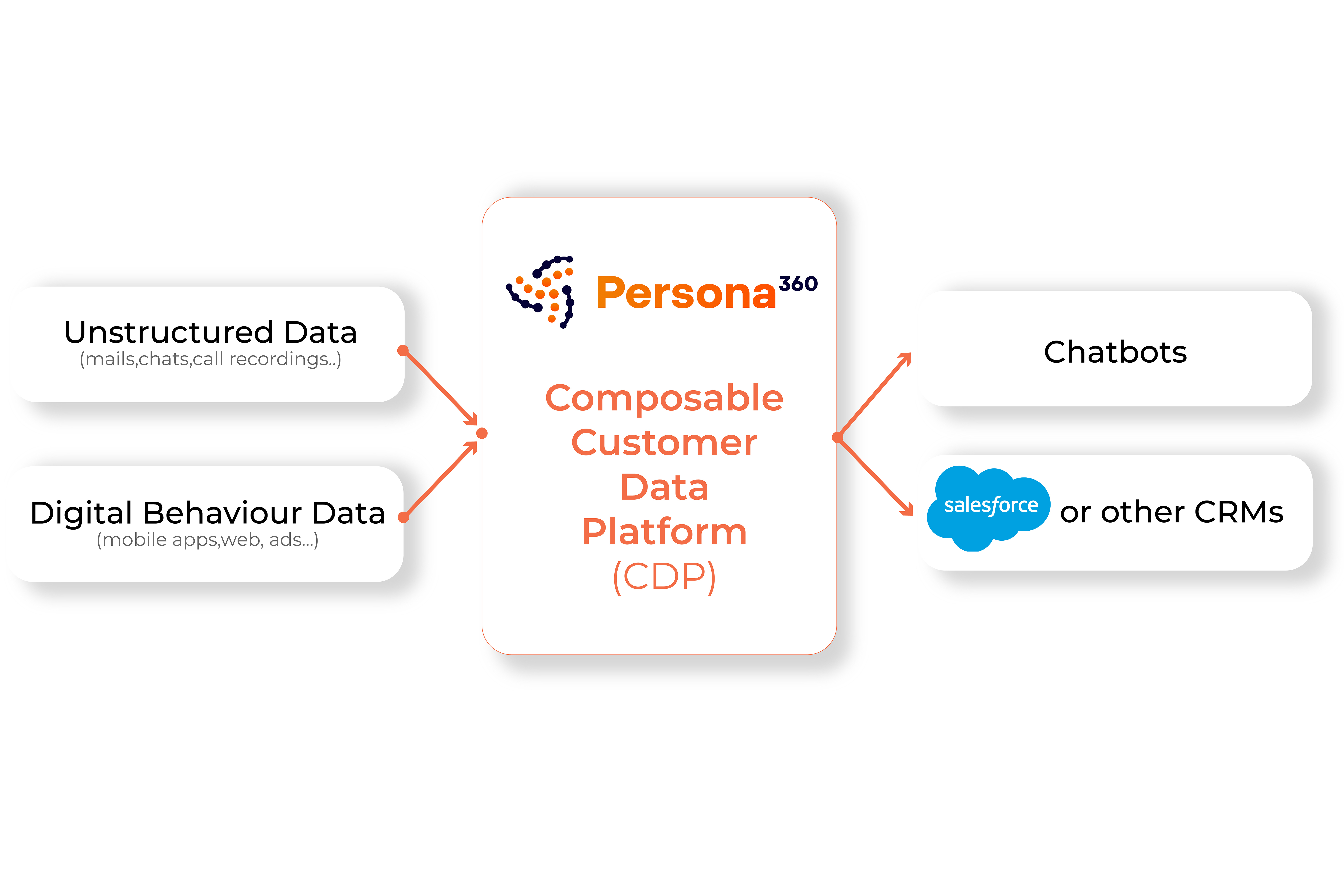

Hyper-Personalization

Key Solutions:

- Using AI to create relevant marketing audiences at scale.

- Detecting new leads and opportunities for communication. with customers (chats, emails, call recordings, PDFs, etc.).

- Personalizing chatbot experiences by adding individual customer data (interests, predictions, etc.).

- Using AI to notify agents about potential upsells.

Dynamic Pricing

Key Solutions:

- Individual pricing engine using AI on a large scale.

- Enriching models with additional information extracted from communications with customers (chats, emails, call recordings, PDFs, etc.).

- AI governance framework for regulatory purposes (EIOPA, etc.). Accelerating AI Transformation in FSI.

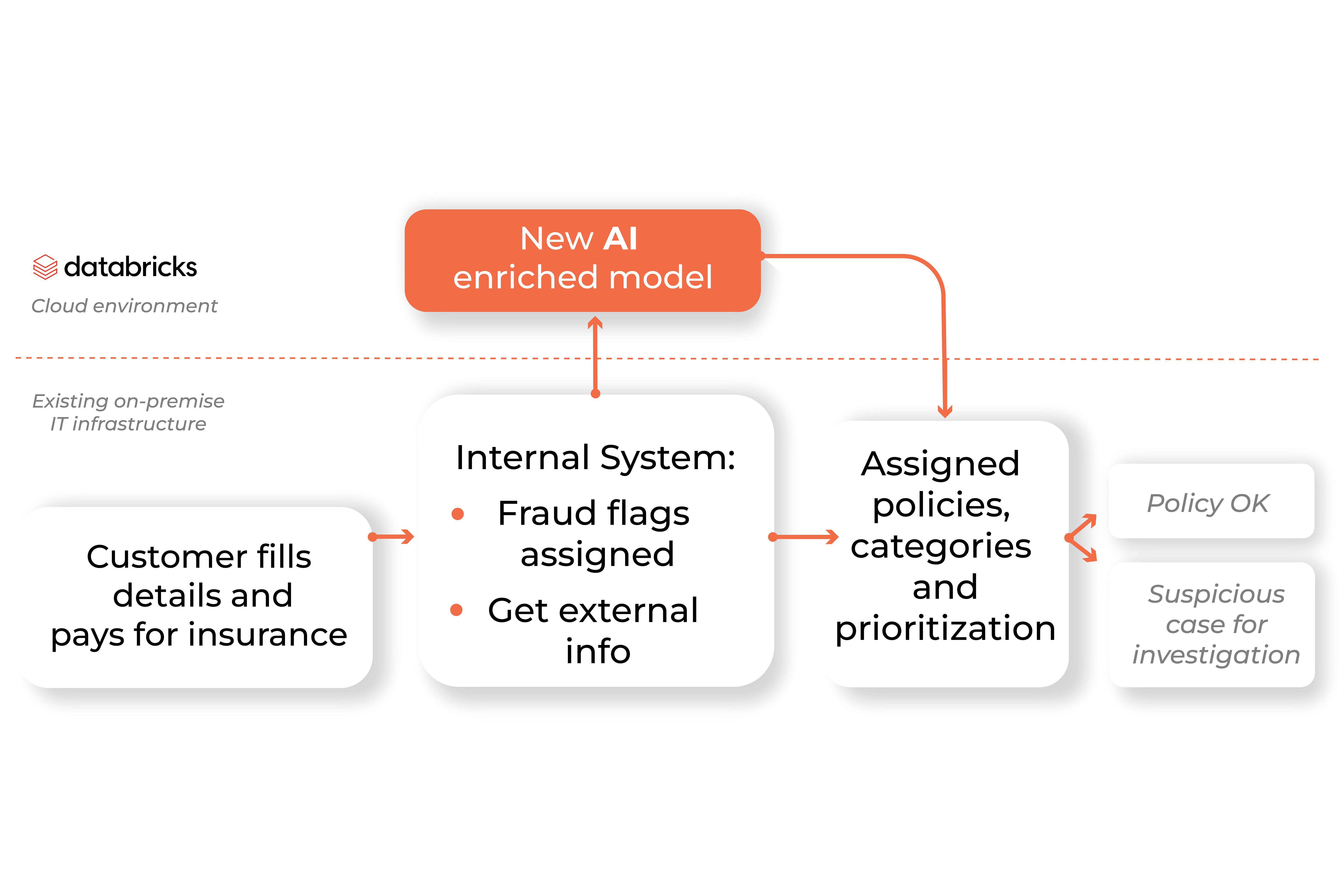

AI against Fraud

Key Solutions:

- Enriching models with Additional information extracted from digital and unstructured interactions with customers (web, chat, call recordings, emails, PDFs,client zone, etc.).

- Using advanced Graph/ML methods to detect fraud/AML.

- Automatically scanning and checking all banker-client communication (calls, chats, emails, etc.).

Our Data AI Product for FSI

Interested in these solutions or seeking something tailored? Get in touch with us.

Need to know More?

Ask us anything

Key contacts

David Vopelka

FinTech lead | AI & personalisation expert

Robert Mihok

AI Solutions Presales & Business Development

Search

Search