35% more conversions

than from one-shot communication

37% higher engagement

through customer communication

45% conversion rate growth

without affecting customer satisfaction

"We have been struggling with our mission to become the most personalised bank in the region. To banks, it's crucial to know a client's life situation and needs and tailor the communication accordingly. Thanks to our new data model, we have access to very interesting customer insights, and we are able to respond quickly to all customer needs and situations."

Personalisation in banking is very different from personalisation in the entertainment industry, although there are some things banks can learn. The banking industry is relationship-based, and the banks need to know their clients well. They do not want to hear about irrelevant offers or and expect bankers to know key information about their product portfolio.

There are multiple data sources which can help banks to create tailored offers for each client. Transactions includes information e.g. about merchants and sales point, that allows for a complex description of customers' behaviour and interests. Combined with socio-demographics, product properties, digital interactions coming from internet banking, mobile applications, voice calls, surveys and other sources, the data create great opportunities for analysis and, as a result, personalisation.

The issue that we have found in pre-eliminary analysis, and the challenge of this project, was the imbalance in one-off communication. The method that Česká Spořitelna has been using up until now has left about 40% of the clients under-communicated.

The Challenge

Our task was to focus on the under-communicated clients, get to know them and approach them in a personalised way on a relevant subject. In order to achieve this goal, we created a 360-degree customer view on the data platform using Databricks on each client and designed a personalised omnichannel multiple-way scenario campaign. In this particular case, Databricks is running on Microsoft Azure. To measure the effect of our way of targeting, we created multiple control groups.

Our Solution in Detail

Persona 360 is an AI-driven tool unifying data from various sources. It contains 1000+ features from sources such as web, digital ads, card transactions, transfer transactions, products, customer interactions, lifestyle, etc. The user can easily historise the data, search for correlations, see relationships among data, integrate marketing tools and much more.

During the first 3 years of our ongoing cooperation with Česká Spořitelna, we have discovered, step-by-step, starting with analysing digital interests from online advertising, that the customers respond much more positively to personalised advertising. Thus, when we did a detailed analysis of contact policy, we wanted to benefit from that finding. We have detected three client groups – under-communicated (less than 4 contacts per year), just right communicated (4-11 contacts per year) and over-communicated (more than 11 contacts per year). We compared the under-communicated clients with the rest and did not find any relevant reason, such as age, salary or account balances, for them to be under-communicated.

After working out a 360-customer view, enriched with all sorts of data, we have learned that over-communicated clients tend to have a high affinity towards loans, while under-communicated clients had a low affinity. In the case of affinity towards investing, the situation was the opposite. Thus, the investment was chosen as a right topic of communication.

After implementing our solution, we were able to create a personalised omni-channel campaign about investments with links to personalised blog posts, targeting under-communicated clients as well as control groups. We used 2 ways of communication – omni-channel scenarios and one-way emails, and 3 personalisation groups based on age (youngsters, middle-aged planners and retired). Our 2 methods of targeting were based on offline affinities – ML model based on offline data (e.g., card transactions, salary, balance, socio-demographic data), and digital affinities - what the clients have read online before closing an investment deal. We have found relevant keywords that we then used to target those clients who have not closed a deal yet. As a measure of success was the click rate on personalised blog post, as the link was included in each step of communication.

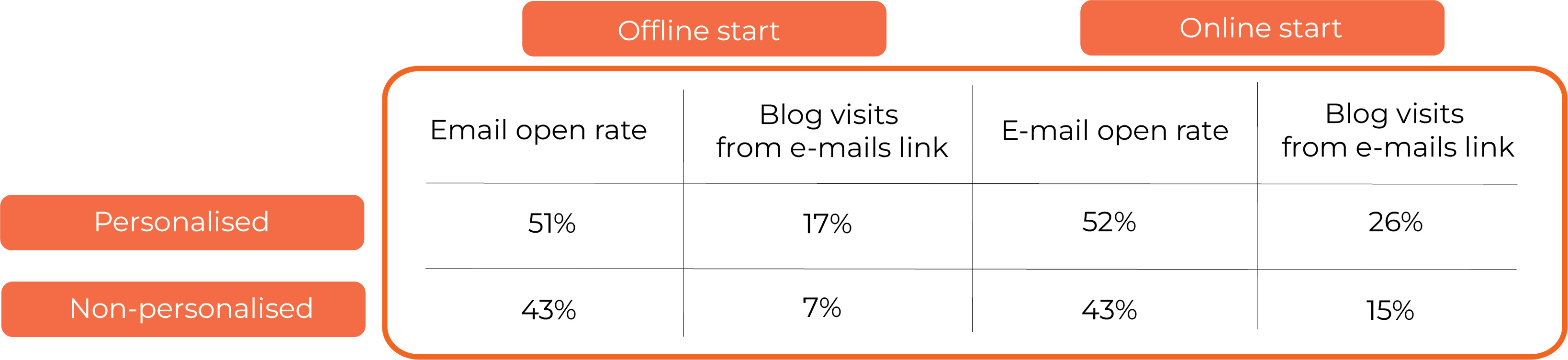

Comparison of e-mail approach. *Offline start = people who didn't see a thematic banner ad; *Online start = people who saw a banner ad

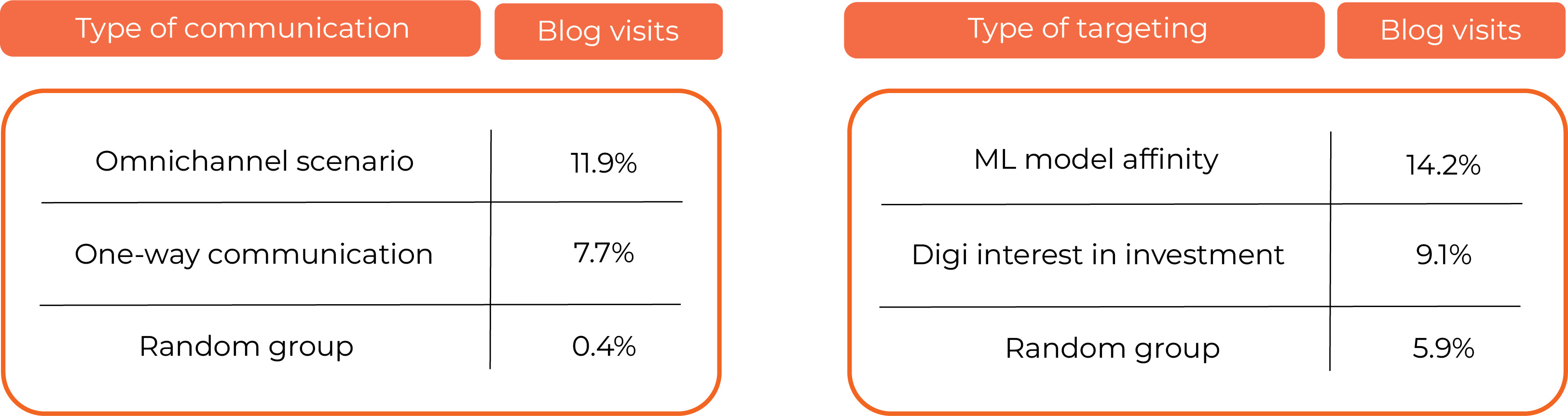

Different types of communication / Different types of targeting

The Outcomes and Benefits

- 3,7x more blog visits from personalised e-mail, after they have seen online ad, compared to traditional one-off communication

- 2,4x more blog visits (from e-mail) in case of personalised e-mail compared to non-personalised e-mails

- 2,4x more blog visits from clients with high ML model affinity compared to control group

- 1,5x more blog visits from omni-channel scenario than from one-shot communication

Clients targeted with omnichannel scenarios visited blog about 54% more than clients targeted with one-shot communication (11,9% vs. 7,7%). Digital banners significantly increased click rates from follow-up e-mail conversations. If the clients saw the online banner before, the click rate was 26% in case of personalised email (15% in case of non-personalised) if they did not, it was 17% in case of personalised email (7% in case of non-personalised). That means digital banners increased the click rate significantly. Choice of audience was also proven to be useful – there were significantly more blog visits in case of clients with high ML model affinity (14,2%) and digital interest in investments (9,1%) than in case of randomly chosen clients in control group (5,9%).

Search

Search