Persona 360: What banks can learn from entertainment companies about personalisation

In the entertainment B2C consumptions market, people usually decide fast and in a short-term perspective. Big, international companies such as Netflix, Instagram, or Spotify have to navigate through a jungle of information in order to understand their needs and predict their goals. They attempt to track their life directions, facilities, and possible destination, such as desired movies, books, or music. If the communication raises expectations and interest, it means they understand their customers well. That’s when we talk about good personalisation.

The situation in the financial market, which is based on trust and long-term relationships, is similar but way more challenging. The banks and investment companies need to explain their product’s benefits, and it’s not as easy to get the clients on board, compared to movies, books, or music. The offered service and the way of communication must consider the client’s life situation, needs and possible life direction, and choose the right place and time. During the two years of cooperation with Česká spořitelna we found the following struggles that kept them away from doing this efficiently:

Relevant customer data

As we mentioned earlier, the banking business is relationship-based, and the banks need to know their clients well. It depends on analysing and understanding customer interactions, interests, and segmentation. The issues are usually caused by limited internal experience in leveraging soft customer behaviour using interaction data.

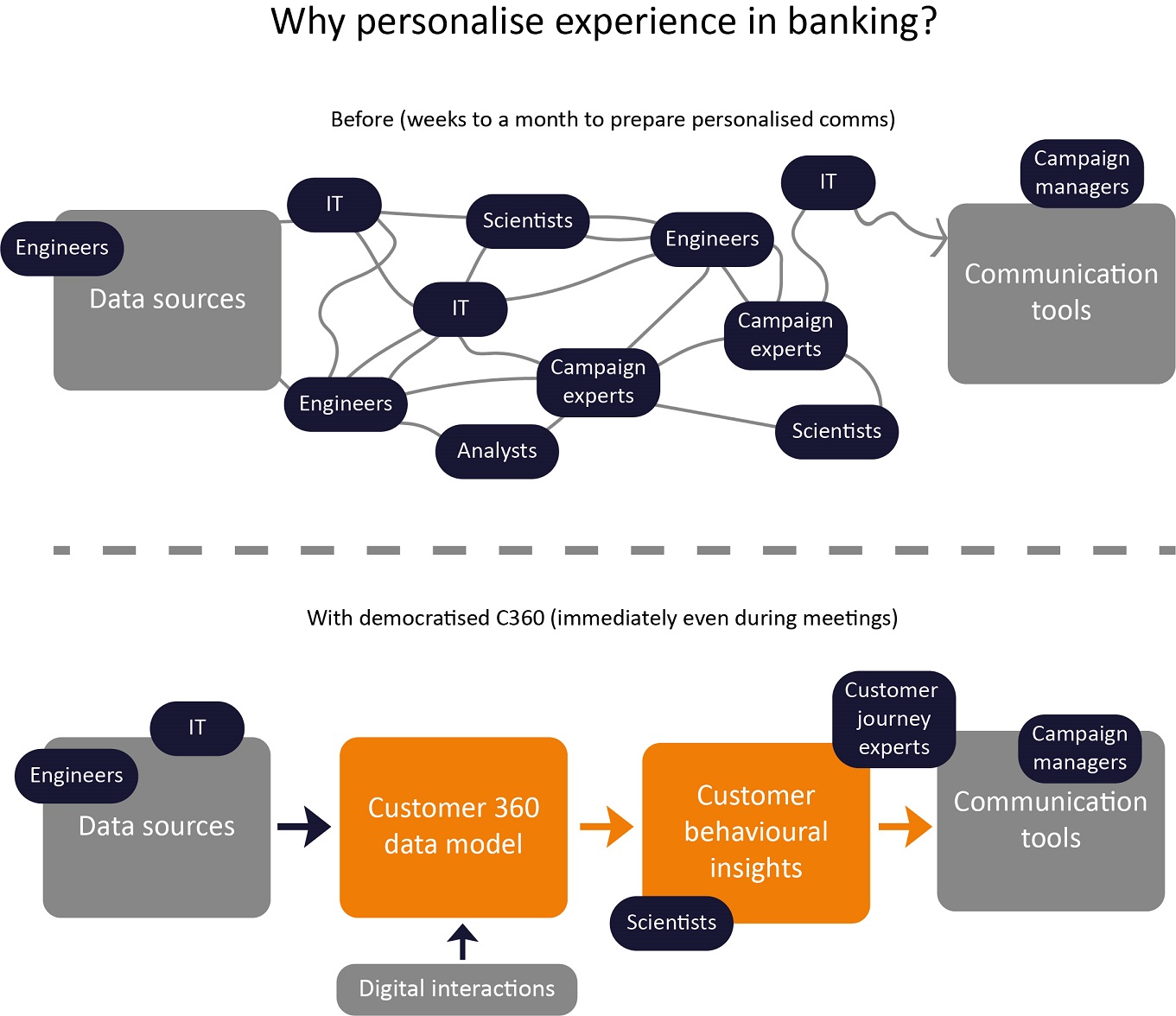

Data workflow and cooperation in banks

The internal data scientists are usually not technically able to impact the actual communication processes and campaign workflows and communication across the company departments.

Clear visualisation and accessibility

The client insights are not easily accessible. The bank needs a sizeable analytical team for a relatively simple task, which takes effort, time, and of course, money. As pictured below, the campaign workflow can be confusing and require too many unnecessary interactions.

How can data science help them face these challenges?

A combination of categorisation, analytical techniques, and advanced NLP may give the bank the key to gathering the customer’s favourite topics, lifestyle, and issues they are dealing with (e.g., saving for retirement, financial independence, savings for children, mortgages). It is also valuable for investing in campaigns and setting up the right content and communication channels.

Card transactions and voice calls might be a hidden treasure

Banks have tons of card transaction data. That includes a purchase, a sales point, and other helpful information that allows for a complex description of customers’ behaviour and interests. Combined with digital interactions coming from internet banking, mobile applications, voice calls, surveys, or the e-course where we collect other information (e.g., time spent on our pages or the sentiment of phone calls), the data create large sets for analysis.

In cooperation with Česká spořitelna, we found that client phone calls make an extremely useful data source of client needs when adequately analysed. This large amount of unstructured information opens opportunities for cloud technology and spark, which is usually very appreciated by data warehouse specialists.

Do you like our approach? Let's get in touch!

Our Customer 360 model for banks and ever-growing set of standard models

After we analyse all possible data sources, it’s time to build a relevant data model that we call the Retail banking 360 model. It’s based on these layers:

- L zero – contains raw data sources (all sources mentioned before).

- L one – the real Customer 360, which describes the customer touchpoints – who, when, where, and what topics should be dealt with.

- Two layers of customer event tables formed into customer journeys.

- A layer of client attributes and micro insights – this is when data scientists plug their customer algorithms into a prepared framework using prebuilt pipelines.

Enter your E-mail address and name to watch

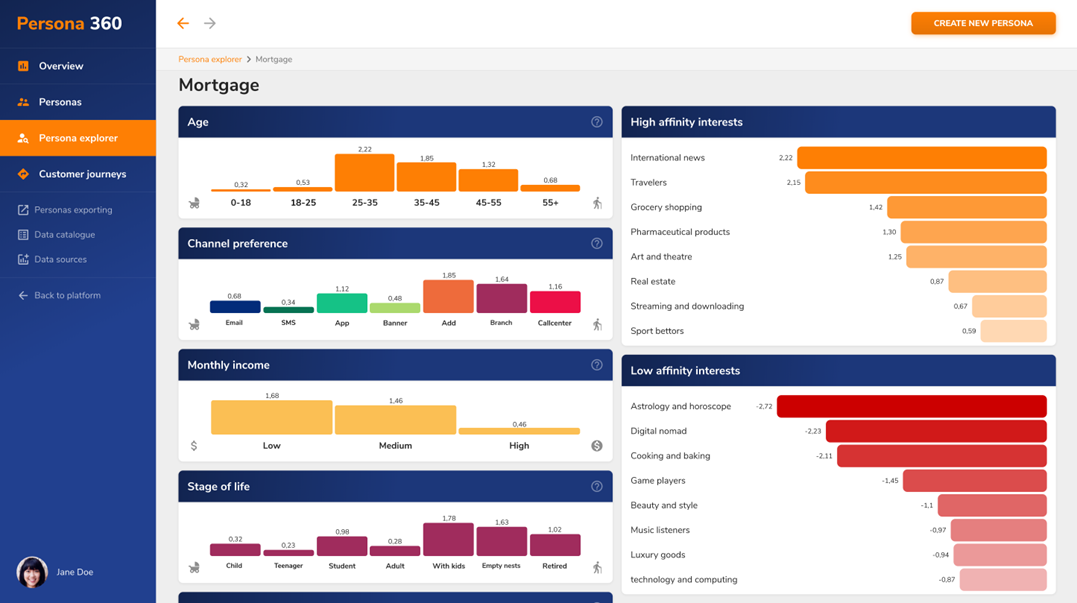

The layers are based on basic ETL but sometimes on very advanced segmentation machine learning calculations. The key benefit is that it does not end up on PowerPoint slides, but it is visualised in an application instead. For Česka spořitelna, we created the Persona application – a simple user interface for customer journey experts.

Data model, machine learning environment, and the application allow us to create various use cases such as retail risk, compliance requirements, customer segmentation, or personalised marketing. It is a popular tool for offline bankers, who can prepare better for client meetings – it can help them predict what issues customers may need help with and give them better advice.

Do you face similar issues and would you like to talk about them with our experts for free?

If you would like further information on this topic, you can watch this presentation by Jakub Štěch and Veronika Pješčaková: Bank Struggles Along the Way for the Holy Grail of Personalisation: Customer 360.

Search

Search